All Categories

Featured

Table of Contents

Performing swiftly might remain in your benefit. In addition, the most charitable plans (in some cases called "ensured problem") may not pay a survivor benefit if you pass away of particular ailments throughout the first 2 years of protection. That's to protect against individuals from acquiring insurance policy instantly after uncovering an incurable ailment. This protection could still cover death from mishaps and various other reasons, so research study the alternatives available to you.

When you assist relieve the financial problem, family and pals can concentrate on caring for themselves and preparing a purposeful memorial rather than scrambling to locate money. With this kind of insurance coverage, your beneficiaries may not owe taxes on the fatality benefit, and the cash can go toward whatever they need many.

Fidelity Burial Insurance

for changed entire life insurance Please wait while we get info for you. To learn about the products that are offered please telephone call 1-800-589-0929. Change Area

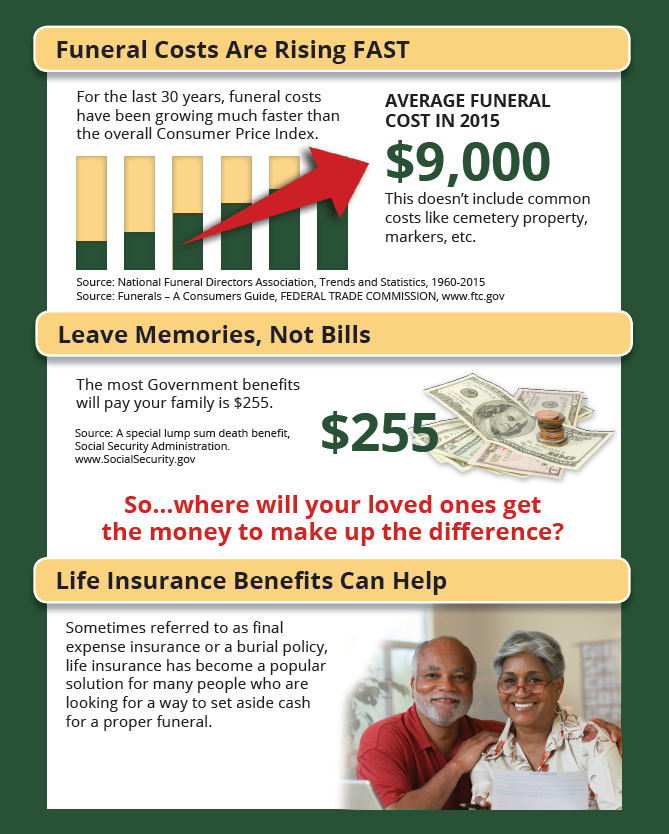

At some point, all of us have to consider exactly how we'll pay for a liked one's, and even our very own, end-of-life expenses. When you sell last expense insurance coverage, you can offer your clients with the satisfaction that comes with knowing they and their households are prepared for the future. You can also profit from a significant chance to maximize your publication of business and produce a charitable brand-new earnings stream! Prepared to discover whatever you need to recognize to begin selling last expense insurance policy efficiently? Nobody likes to consider their own fatality, however the reality of the issue is funerals and interments aren't economical (final expense direct houston tx).

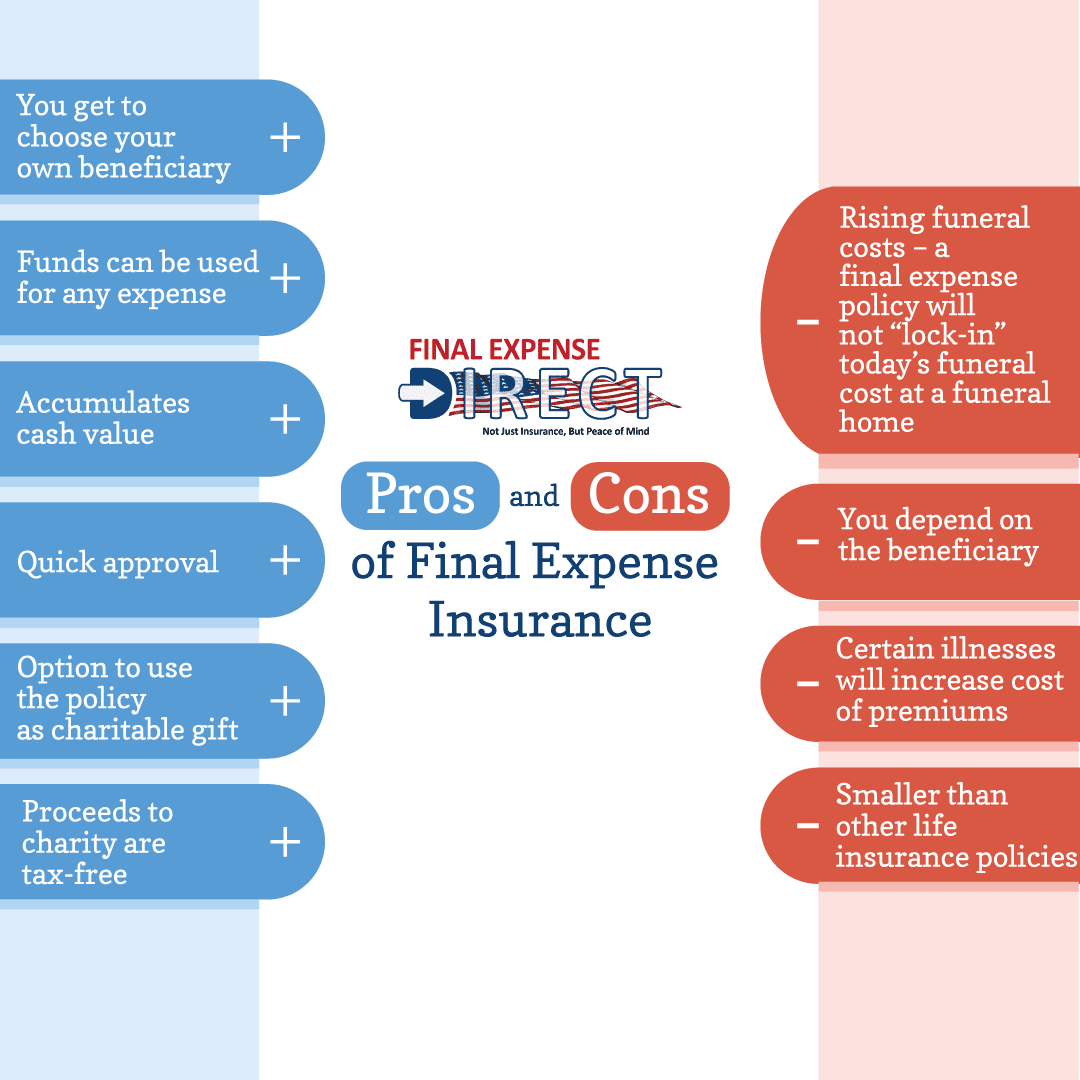

As opposed to offering earnings replacement for loved ones (like most life insurance coverage policies do), last expense insurance is meant to cover the prices connected with the insurance holder's watching, funeral, and cremation or burial. Lawfully, nonetheless, beneficiaries can frequently use the plan's payment to spend for anything they desire. Generally, this kind of policy is issued to individuals ages 50 to 85, however it can be issued to younger or older people also.

There are four main kinds of last expenditure insurance coverage: assured problem, graded, customized, and level (favored or common rating). We'll go extra right into detail about each of these product types, but you can acquire a fast understanding of the distinctions between them using the table listed below. Specific advantages and payment timetables may differ relying on the service provider, strategy, and state.

Seniors Funeral Cover

You're guaranteed protection yet at the highest rate. Generally, assured concern final expense strategies are issued to clients with extreme or numerous health issues that would certainly stop them from securing insurance at a common or rated ranking. finalexpensedirect. These health and wellness conditions might consist of (however aren't restricted to) kidney condition, HIV/AIDS, organ transplant, energetic cancer cells therapies, and illnesses that restrict life span

On top of that, customers for this sort of plan might have extreme legal or criminal histories. It is necessary to keep in mind that various service providers use a series of concern ages on their assured problem policies as reduced as age 40 or as high as age 80. Some will certainly likewise provide higher stated value, as much as $40,000, and others will enable far better death advantage conditions by boosting the rate of interest with the return of premium or minimizing the variety of years till a full survivor benefit is offered.

If non-accidental death occurs in year two, the provider could just pay 70 percent of the death advantage. For a non-accidental death in year 3 or later, the service provider would possibly pay one hundred percent of the survivor benefit. Modified last expenditure plans, similar to rated plans, look at health and wellness conditions that would certainly put your customer in a much more restrictive modified plan.

Some products have certain wellness issues that will certainly obtain favoritism from the provider. There are carriers that will release plans to younger grownups in their 20s or 30s who can have persistent problems like diabetes. Normally, level-benefit conventional final expenditure or simplified problem whole life strategies have the most affordable premiums and the largest schedule of added cyclists that clients can contribute to policies.

Burial Insurance In California

Relying on the insurance provider, both a preferred price course and standard price course may be offered - burial insurance with pre existing conditions. A customer in superb health and wellness with no existing prescription drugs or health problems may get approved for a recommended rate course with the most affordable premiums possible. A customer healthy even with a few maintenance medications, but no significant health and wellness concerns may receive conventional prices

Comparable to various other life insurance policy plans, if your customers smoke, utilize other types of cigarette or pure nicotine, have pre-existing health and wellness problems, or are male, they'll likely need to pay a greater rate for a final cost plan. Furthermore, the older your client is, the higher their price for a strategy will be, because insurance provider think they're taking on even more danger when they provide to insure older clients.

Insurance To Pay For Funeral

The plan will also stay in force as long as the insurance holder pays their premium(s). While numerous various other life insurance policy policies may need medical tests, parameds, and attending medical professional statements (APSs), final expenditure insurance policy plans do not.

To put it simply, there's little to no underwriting called for! That being claimed, there are two main kinds of underwriting for final cost plans: simplified concern and ensured issue (burial insurance in louisiana). With streamlined issue plans, clients usually only need to respond to a few medical-related questions and might be rejected insurance coverage by the carrier based on those responses

Funeral Insurance Expenses

For one, this can enable representatives to figure out what type of plan underwriting would function best for a specific client. And two, it aids representatives narrow down their customer's alternatives. Some carriers may disqualify customers for protection based on what medications they're taking and the length of time or why they've been taking them (i.e., maintenance or therapy).

The brief answer is no. A last cost life insurance policy policy is a kind of irreversible life insurance policy policy - final expense policies. This suggests you're covered till you die, as long as you've paid all your costs. While this plan is created to assist your recipient pay for end-of-life expenditures, they are complimentary to use the death benefit for anything they require.

Just like any kind of various other long-term life policy, you'll pay a routine costs for a final expense plan for an agreed-upon death benefit at the end of your life. Each carrier has various guidelines and alternatives, however it's relatively very easy to take care of as your recipients will have a clear understanding of how to spend the money.

You might not need this kind of life insurance. If you have permanent life insurance in position your last costs might currently be covered. And, if you have a term life policy, you might have the ability to transform it to an irreversible policy without a few of the extra steps of getting last cost protection.

Burial Insurance Life

Made to cover limited insurance coverage demands, this sort of insurance policy can be a cost effective alternative for individuals who merely wish to cover funeral expenses. Some plans may have constraints, so it is essential to check out the small print to be certain the policy fits your need. Yes, naturally. If you're seeking a permanent alternative, global life (UL) insurance policy remains in position for your entire life, so long as you pay your premiums. senior care final expenses.

This alternative to last cost coverage offers choices for extra family members insurance coverage when you require it and a smaller sized insurance coverage amount when you're older.

Neither is the thought of leaving enjoyed ones with unforeseen expenditures or debts after you're gone. Consider these 5 truths regarding last expenditures and just how life insurance can aid pay for them.

Latest Posts

Funeral Expense Calculator

All Life Funeral

Final Expense Insurance Impaired Risk